What will happen to the euro and the dollar

The in-depth study by Cinzia Guerrieri for Ispi

Since last autumn, the euro / dollar exchange rate has started a bearish phase in the face of the prospects of normalization of the monetary policy of the United States with respect to a still accommodative stance of the European Central Bank. In the first two months of 2022, the exchange rate fluctuated around 1.13 dollars per euro, down from the 1.18 average recorded in the previous year. With Russia's invasion of Ukraine on February 24, we are witnessing an acceleration of this phase, with the rate reaching 1.05 (the lowest since 2016), losing around 7% since the outbreak. of the conflict. The downward factors that affect – directly and indirectly – the price are many.

THE CAUSES OF THE STRENGTHENING OF THE DOLLAR

First, the monetary policy divergence between the Federal Reserve and the ECB has widened further in recent months. Last March, the Fed began its first hike (of seven expected in 2022) and, according to financial market expectations, the federal fund rate would rise to over 2.5% by the end of the year, implying a restrictive stance . This is also part of a context of the end of the plan for the purchase of financial assets, which will also be accompanied by the gradual reduction of the reinvestments of the securities which have reached maturity, thus determining a downsizing of the balance sheet.

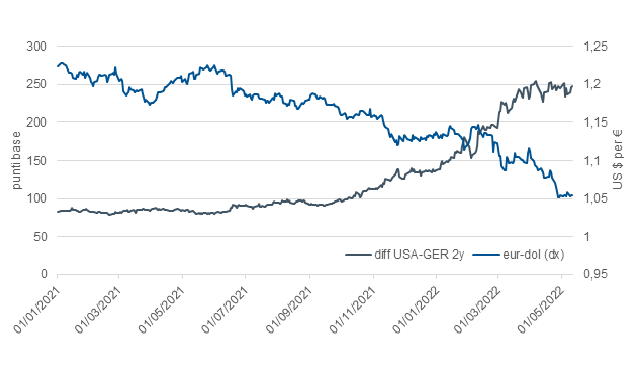

On the other hand, the ECB has not announced interest rate increases but has initiated the reduction of purchases of securities while maintaining the reinvestment for a long time to come. Although the financial markets have begun to price one or two increases in the Eurozone as early as July (and the recent statement by ECB President Christine Lagarde should be interpreted in this direction), the increase could be minor and would occur at a much more gradual pace. This divergence in turn reflects a different macroeconomic context: in the USA, inflationary pressures are widespread in the various sectors of the economy and depend not only on the criticality of supply but also on solid demand and labor market conditions; on the other hand, in the Eurozone core inflation – ie net of the more volatile components such as energy and food – still remains at relatively lower levels (albeit on an increasing trend). This is therefore reflected in the inflation expectations (on levels beyond the target for the FED, while still substantially in line for the ECB) and on the yield differential between American and German government bonds, leading to an inflow of capital towards the USA. and therefore the appreciation of the dollar (Fig. 1).

Figure 1. – Euro / dollar vs yield differential between 2-year US-German government bonds

Added to this is the worsening of the prospects for the global economy compared to the forecasts made at the beginning of the year by the consensus, mainly attributable to the impacts of the war between Russia and Ukraine. Although these two countries have a modest weight on the world economy, at the same time they exert an important influence as global suppliers of some energy (natural gas and oil), agricultural (cereals such as wheat, corn and seed oil) raw materials. sunflower), industrial (metals such as palladium and nickel) and inert gas (for example, the neon used in the production of lasers in turn used for the manufacture of microprocessors). The first effects are already visible on the prices of commodities in the financial markets, which are part of a bullish phase underway since the second half of 2021. The European Union, inserted by the Russian government among the "hostile countries" in response to Western sanctions , represents the area most exposed to the impacts of the conflict both due to its geographical proximity and to its high dependence on energy supply and the supply of numerous production inputs. Furthermore, in the last month, the lockdowns underway in several strategic cities in China (from Shanghai to Shenzhen), due to the zero tolerance policy against Covid-19 pursued by the Beijing government, are further weighing on the already high criticalities along international supply chains.

The increase in production costs together with the lower availability of some raw materials, the deterioration in the climate of confidence and the increase in uncertainty inevitably have an impact on the growth of world GDP in 2022, markedly revised downwards while remaining in positive territory ( + 3% according to recent estimates by Oxford Economics, well below the 3.6% expected by the International Monetary Fund in the April World Economic Outlook ).

In this uncertain environment, with significant downside risks fueled by multiple fronts, the dollar is strengthening its safe-haven status (while the price of gold is falling). The American currency has appreciated, in fact, not only against the euro but also against a basket of currencies, thanks to its ability to perform the three crucial functions of global currency, i.e. means of payment in international commercial transactions, a settlement instrument in financial markets (many commodities are quoted in dollars) and store of value held by other central banks. In light of these considerations, a further depreciation of the euro against the dollar cannot be excluded, which could reach parity by the end of the year – for the first time since 2003.

WHAT CONSEQUENCES FOR EUROPEAN AND ITALIAN EXPORT?

What could be the implications for Italy? On the one hand, a stronger dollar makes American imports from the world cheaper and, in this direction, the estimate on the growth of US imports has been revised significantly upwards (from 5.3% expected before the outbreak of the conflict to recent + 10.8%, measured by volume for goods and services, according to OE). The greater demand for goods produced abroad by American consumers certainly represents an opportunity for Italian exporting companies. The United States is the third outlet market for Made in Italy (after Germany and France, first among non-EU countries), with a weight of approximately 9.6% on national exports of goods around the world in 2021. In the first quarter of 2022, the trade balance (i.e. the difference between our exports and imports of goods in value to / from the USA) recorded a positive balance and, presumably, will remain on the increasing trend observed in the year. last decade (with the exception of the slight decline recorded in 2020).

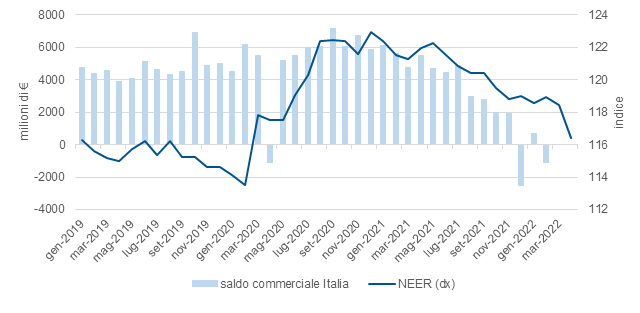

On the other hand, Italy's trade balance of goods in the world could suffer a sharp deterioration due to the weakening of the euro, through the channel of raw materials and imported production inputs. As mentioned above, the surge in commodity prices is further accentuated by the appreciation of the dollar (the relative markets being regulated in many cases in the US currency). The risk is that of an increase in imported inflation (which further weighs on the dynamics of consumer prices) and a worsening of the trade balance. Already in the first two months of 2022, the cumulative balance was negative with a trend decline of over 200% compared to the same period last year, attributable to an increase in the value of imports of goods significantly higher than that of exports (Fig. 2).

Figure 2. – Italy's trade balance vs nominal effective exchange rate of the euro (monthly data)

In a scenario of further depreciation of the euro during 2022, the trade balance should record a positive balance on average for the year thanks to the improvement in the competitiveness of Made in Italy in foreign markets, but would be markedly downsized compared to what has been observed over the years. passed due to the sharp increase in the value of imports (only partially offset by the partial reduction in the prices of energy raw materials assumed in the second half of the year).

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/che-cosa-succedera-a-euro-e-dollaro/ on Sun, 22 May 2022 05:25:13 +0000.