What will the US debt ceiling deal look like?

A comment by Libby Cantrill, Head of US Public Policy at Pimco, on the state of play of the negotiations on the US debt ceiling and on the impacts on the markets.

We strongly believe that the recent negotiations , which have followed and are still following, will lead to a debt ceiling agreement before the "X date" set by the US Treasury for June 1st (i.e. the date estimated that the federal government will no longer have sufficient funds to pay its expenses), although it will probably happen literally in extremis. After all, neither party seems to have a political incentive either to give rebates before absolutely forced to, or to default. To use an apt if vivid analogy: Passing the debt ceiling is like getting rid of a kidney stone: we know it will pass, just figure out how painful it will be. We could say that right now we are in a painful period.

Indeed, while both political camps have tested the limits of a possible debt ceiling deal with new demands (e.g., immigration reform for Republicans, tax hikes for Democrats), the overall pattern hasn't changed much. in recent weeks: recovery of unused COVID-19 funds, caps on "discretionary" spending (which represents about 25% of the US government's $6 trillion annual budget), work requirements for certain relief programs (which have a decent successful, but tend to be costly to administer and therefore do little to contain the deficit), and potentially some down payment in energy permit reform (for both traditional and clean energy). We may also see changes to how Medicare reimburses you for hospital benefits.

EXPENDITURE DETAILS

The real hurdles, however, appear to be in the details of spending:

- Set the so-called spending base for FY 2024: If FY 2024 spending is restored to FY 2022 levels, as Republicans are calling for, that is likely to result in short-term cuts to discretionary spending and longer-term savings on the deficit. If FY 2024 spending were set at FY 2023 levels — the Democrats' call — that would likely result in a discretionary spending freeze (i.e. no cuts), but would still represent a longer-term deficit reduction on a span of 10 years.

- The depth and composition of spending caps: The themes are how much spending growth will slow down relative to Congressional Budget Office (CBO) projections (i.e., how much growth will be “constrained”) and how these caps will be placed on discretionary non-defense spending (from national parks to meat inspectors) versus defense spending. There is also the question of the duration of the spending caps: the Democrats want two years, the Republicans have asked for ten.

Overall, we believe they will find a footing that is likely to result in few, if any, short-term spending cuts, but yield long-term savings on the deficit versus current CBO projections. Of course, to really address the country's fiscal sustainability, they would have to address the elephant in the room, ie spending on welfare programs, but this is not a politically viable option for either side in the foreseeable future.

THE TIMELINE FOR A DEBT CEILING AGREEMENT

By when will lawmakers realistically have to reach an agreement? Everyone is working to meet the X date of June 1 set by the Treasury. To meet that deadline, negotiators are likely to need to reach an agreement in principle by the middle of this week in order to draft legislation and proceed with consultations in the House and Senate. Once an agreement is reached in principle, further problems may arise in garnering enough support for the agreement in their respective party bases, but we believe there will be enough support from both parties to pass the law. Also, if Congress needs more time to negotiate or get the bill on paper, it's possible we could see a short-term extension of a week or two at most.

MARKET FORECASTS AND REACTIONS

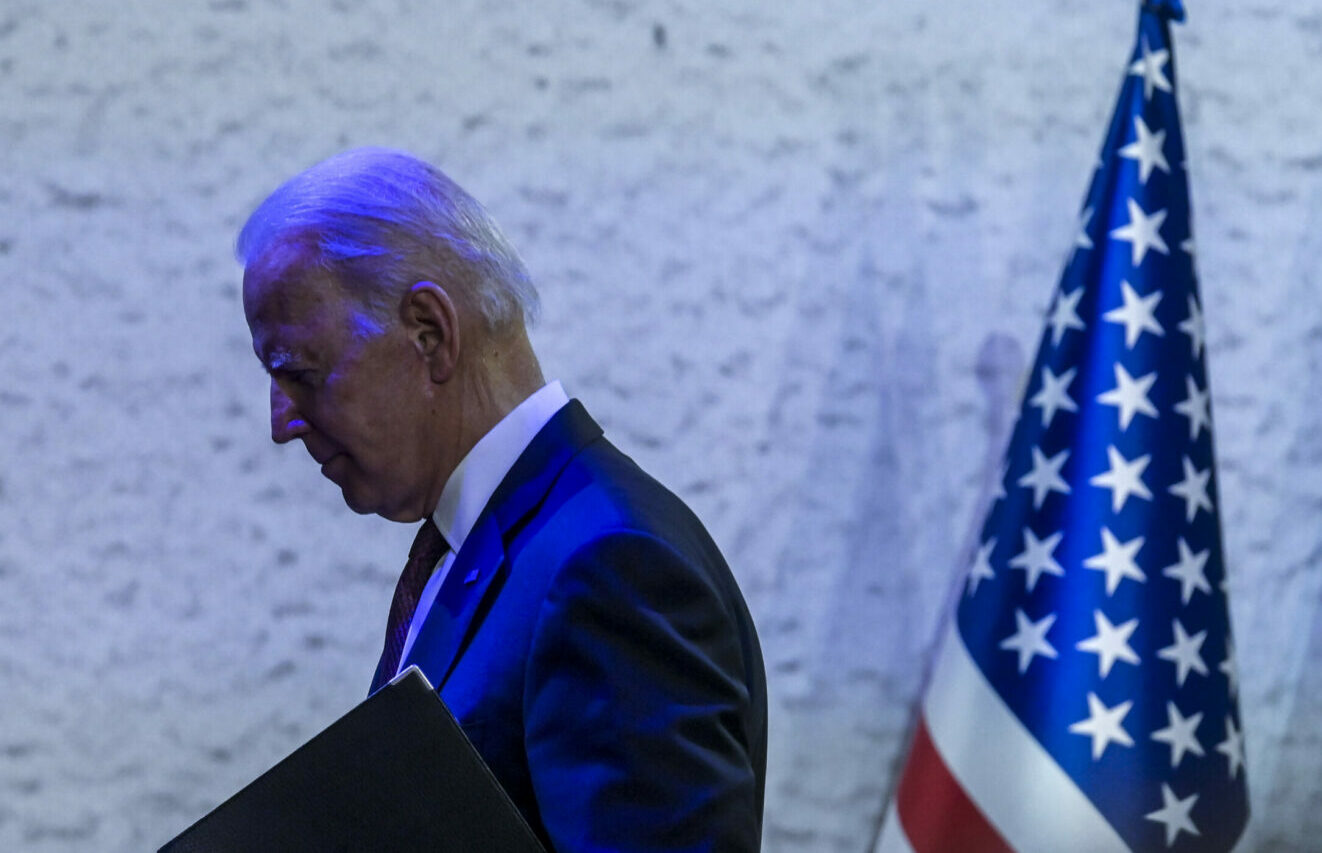

We don't expect the invocation of the 14th Amendment. There has been more noise recently over President Joe Biden's possible appeal to the 14th Amendment to effectively ignore the debt limit, citing the clause that public debt "must not be questioned." However, Treasury Secretary Janet Yellen continues to insist that the only way the debt ceiling can be addressed is through Congress. From a market perspective, the use of the amendment seems unlikely, given the uncertainty it could cause, and it also seems unlikely from a political point of view, given the foreseeable repercussions.

Market Reaction : Based on past debt ceiling situations, equity markets could fluctuate this week depending on how negotiations progress, but if the anticipated deal crystallizes and there is no default, markets could likely retrace after a resolution. (There was one exception in 2011, when stock markets continued to fall after the resolution and date X, partly due to the European debt crisis and partly due to the anticipation of large spending cuts that part of the resolution). That said, we have already seen significant distortions in the fixed income market, creating both risks and opportunities.

Bottom line : While the next few days or next week are likely to be very chaotic, we remain optimistic that an agreement will be found before date X of June 1st, with the remote possibility of a short-term extension (of weeks, not months) . As a result, lawmakers (and markets) probably won't have to deal with the debt ceiling again until 2025, after the highly anticipated 2024 election. No one seems to have the political incentive to compromise before the last minute, so we could see some stress and strain ahead of next week's deadline, but the overall result seems clear to us: The resolution of the debt ceiling will pass.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/stati-uniti-tetto-debito-trattative/ on Thu, 25 May 2023 09:11:11 +0000.