Why are bank loans to companies collapsing? Report One company

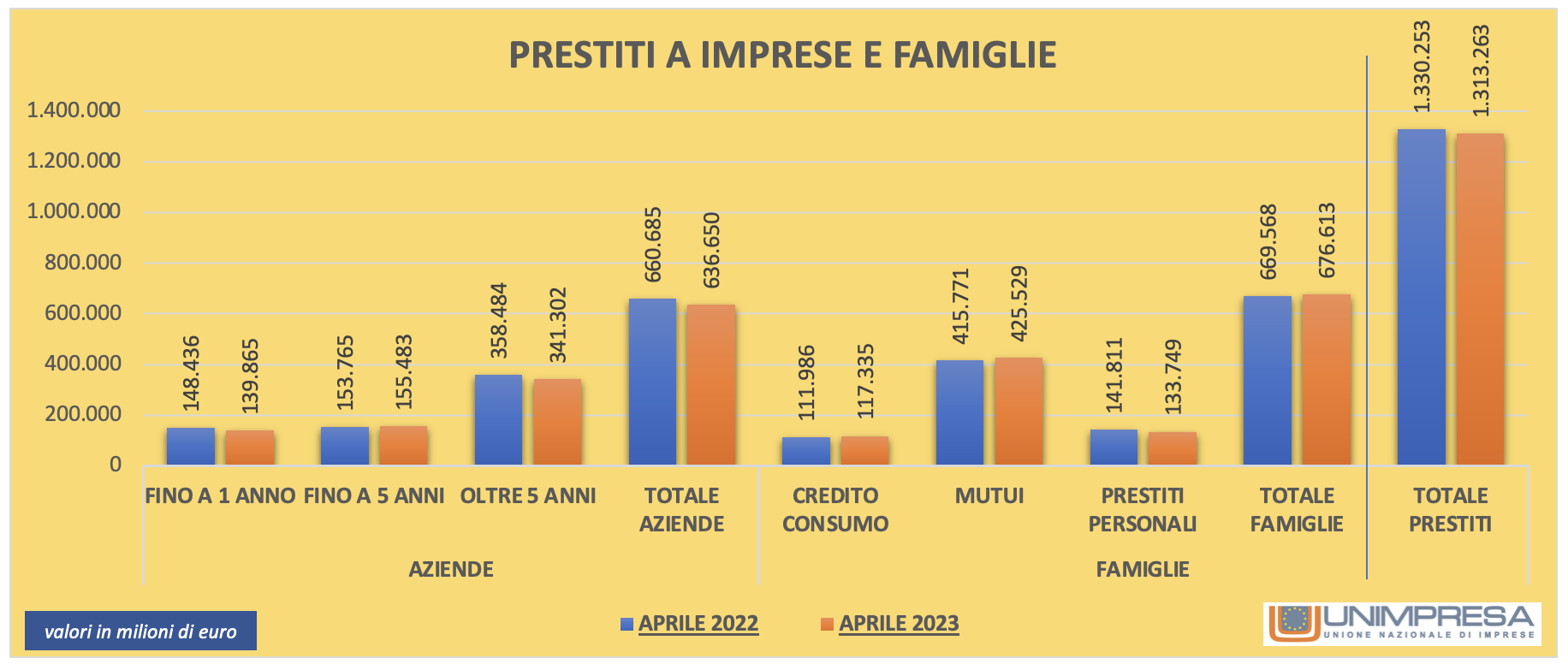

From April 2022 to April 2023, bank loans to households increased by over 7 billion euros, while those intended for companies fell by over 24 billion. What the Unimpresa report says

Double speed bank loans, in the last 12 months, with an alarm bell for the entire credit sector. From April 2022 to April 2023, bank loans to households increased by over 7 billion euros (+1), while those intended for companies fell by over 24 billion (-3.6%). In total: minus 17 billion to private individuals between the first quarter of 2022 and the first four months of this year, but the drop was mitigated both by the growth in consumer credit (that intended for the purchase of smartphones and cars), increased by 4.7% with more 5 billion, and by the rush of real estate mortgages, increased by 2.3% with a surge that is close to 10 billion.

BAD LOANS OVER 15 BILLION

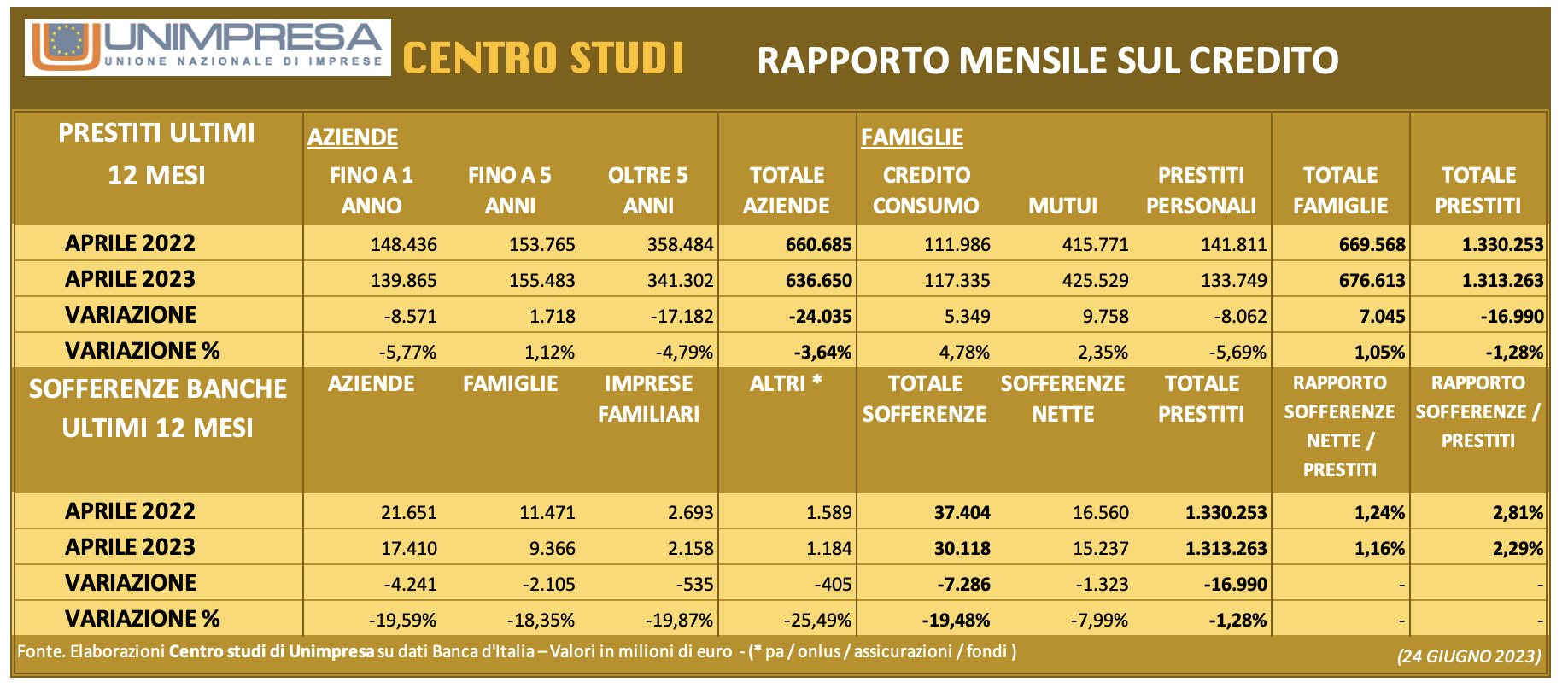

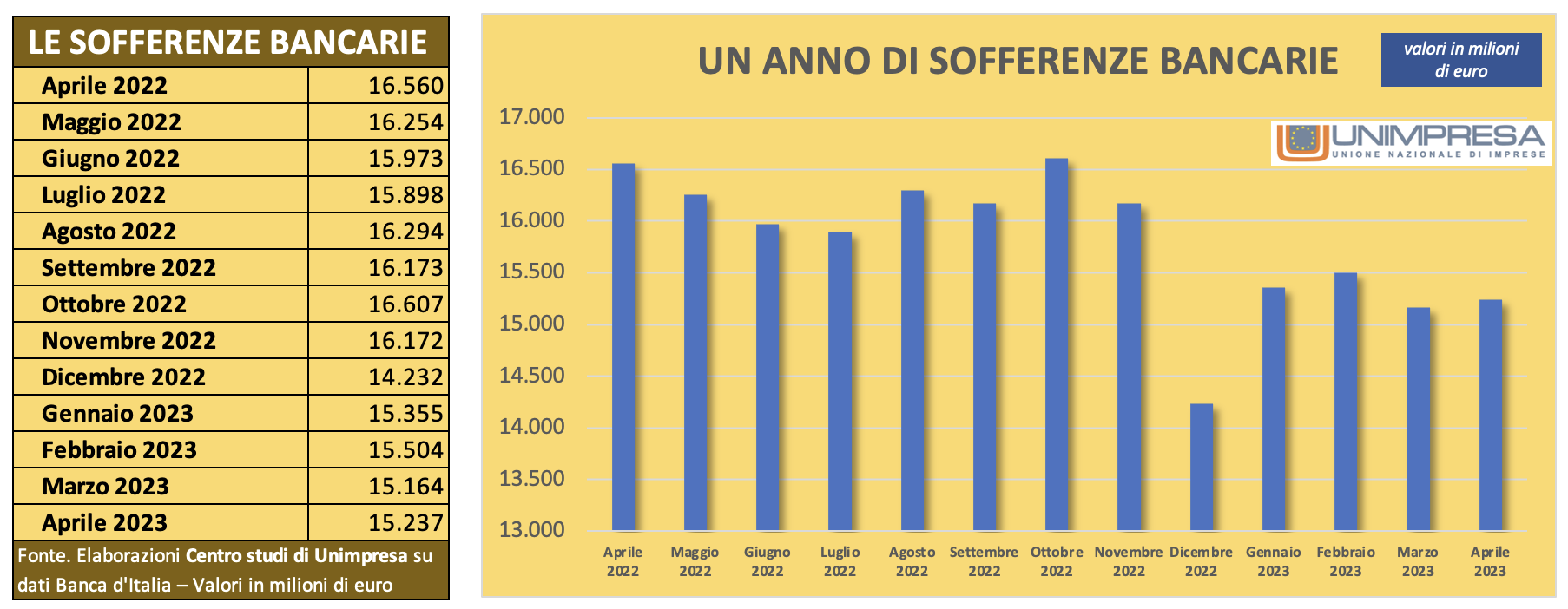

In the meantime, thanks to the slowdown in economic growth and the rise in interest rates, the amount of non-performing loans has started to grow again, which last April, after a long period of decreasing trend, once again reached over 15 billion euro, down by 1.3 billion on an annual basis, but up by more than one billion compared to December 2022. This is what emerges from the monthly report on credit produced by the Centro studi di Unimpresa, according to which the stock of bank loans to businesses and households fell, net of securitizations, by 1.28%, from 1,330 billion in April 2022 to 1,313 billion in April 2023.

THE COMMENT OF SPADAFORA (UNIMPRESA)

«As the Minister of the Economy, Giancarlo Giorgetti rightly underlined, the gloomy cloud of the European Central Bank's monetary policy is gathering on the bank lending scenario. With eight rises in the reference rate in just 11 months, the conditions for accessing loans have become de facto prohibitive and those with variable-rate loans had to face an unexpected increase in the cost of debt with borrowing costs also rising by 70%. All this represents a boulder for companies, in particular for small and medium-sized enterprises: those that do not have sufficient liquidity reserves to cover this phase find themselves in enormous difficulty. It is a very serious problem which the government must take on, on the one hand with moral suasion towards the top management of the banking sector, on the other by refinancing the state guarantee fund in order to contain the rates on new loans» comments the vice president of An enterprise , Giuseppe Spadafora .

ALL DATA ON BANK LOANS FROM APRIL 2022 TO APRIL 2023

According to the report by the Unimpresa Study Centre, which re-elaborated data from the Bank of Italy, total loans from banks to the private sector, net of securitisations, went from 1,330.2 billion in April 2022 to 1,313.2 billion in April 2023, down by 16.9 billion (-1.28%).

«These data, sometimes disputed by the credit sector associations, do not take into account the securitization of loans, i.e. largely non-performing loans that the banks have transferred, during the period in question, to vehicle or specialized companies. If those values were calculated in the total account, the results would be different, however it seems more correct to take into consideration only the credit resulting in bank assets or the one that is the basis of the relationship between the bank and its customers» observe the analysts of Unimpresa.

LOANS TO COMPANIES

More specifically, loans to companies went from 660.6 billion in April 2022 to 636.6 billion last April, with a decrease of 24.1 billion (-3.64%). Short-term loans (up to 1 year in duration) decreased, going from 148.4 billion to 139.8 billion, down by 8.5 billion (-5.77%), as well as long-term loans (maturing over 5 years), which went from 358.4 billion to 341.3 billion, down by 17.1 billion (-4.79%). Conversely, medium-term credit (up to 5 years) went against the trend, up by 1.7 billion (+1.12%) from 153.7 billion to 155.4 billion.

LOANS TO FAMILIES

As regards loans to households, consumer credit and mortgage loans favored overall growth of 7.1 billion (+1.05%) from 141.8 billion to 133.7 billion; consumer credit (i.e. that granted mainly for the purchase of travel, furniture, cars, household appliances, computers and smartphones) increased by 4.78% with a growth of 5.3 billion from 111.9 billion to 117.3 billions; loans to buy homes rose by 2.35% with a positive variation of 9.7 billion from 415.7 billion to 425.5 billion.

On the other hand, there was a decrease of 8.1 billion (-5.69%) for personal loans (those granted without a specific purpose), which went from 141.8 billion to 133.7 billion.

UNPAID INSTALLMENTS

As regards unpaid installments, there was a general drop in gross non-performing loans of €7.2 billion (-19.48%) from €37.4 billion in April 2022 to €30.1 billion in April 2023. The ratio between gross non-performing total loans to the private sector went from 2.81% to 2.29%. Net non-performing loans decreased on an annual basis by 1.3 billion (-7.99%) from 16.5 billion to 15.2 billion, but a sudden growth was observed between last December, when they reached 14.2 billion , and April, with 1 billion in rotten credit accumulated in just four months.

The ratio between net non-performing loans (those not covered by real guarantees) and total loans to the private sector went from 1.24% to 1.16%. In general, bad debts of all customer categories decreased on an annual basis: those attributable to companies decreased by 4.2 billion (-19.59%), from 21.6 billion to 17.4 billion; those of households decreased by 2.1 billion (-18.35%), from 11.4 billion to 9.3 billion; those of family businesses decreased by 535 million (-19.87%), from 2.6 billion to 2.1 billion; those referable to the public administration, funds, insurance companies and non-profit organizations also fell, passing from 1.5 billion to 1.1 billion with a negative change of 405 million (-25.49%).

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/prestiti-banche-famiglie-aziende-aprile-2023-unimpresa/ on Mon, 26 Jun 2023 08:23:39 +0000.