Why is the ECB phlegmatic despite the war?

How I will change the monetary policy of the ECB. The comment by Luca Mezzomo, Head of Macroeconomic Analysis of Intesa Sanpaolo, on the last meeting of the ECB

The European Central Bank confirmed the acceleration of the monetary policy normalization process, despite the uncertainty caused by the Russian invasion of Ukraine. The first assessments of the economic impact of the latter appear very mild, at least in the central forecast scenario. The ECB is keeping an escape route open by not committing to a given level of net purchases in the third quarter (as we imagined) and specifying that the time interval between the end of the purchases and the first rate hike will also depend on the data.

As expected, the closing of the PEPP net purchases on March 31st was confirmed. The confirmation that the special conditions on TLTRO III operations will expire in June is also in line with expectations. On the other hand, an acceleration in the closure of net APP purchases was not expected, which instead exists. In detail:

- In the second quarter, APP net purchases are confirmed at 40 billion monthly in April, but will then be reduced to 30 billion in May and 20 billion in June.

- In the third quarter, the volume of net purchases will depend on the data. If they confirm the expectation that the medium-term scenario will not weaken after the end of net purchases, then APP net purchases will be stopped "in the third quarter".

The ECB continues to stress the importance of PEPP reinvestments as a potential stabilization tool.

The ECB has changed the forward guidance on rates in two respects. The first is formal: the possibility of rate cuts is no longer mentioned. The most significant change is that the sequence has been modified to indicate that the rate hike will take place "some time after" the end of net purchases – a more easily managed formulation from a communicative point of view than the previous one, where the time of the rate hike was determined by conditions and the end of the purchases occurred shortly before. Furthermore, the increases will be "gradual". Several times, the president has remarked that the exact time will be determined by the data, and not by the calendar. Given the uncertainty of the scenario, the new formulation makes it possible to better adapt the normalization step to the circumstances.

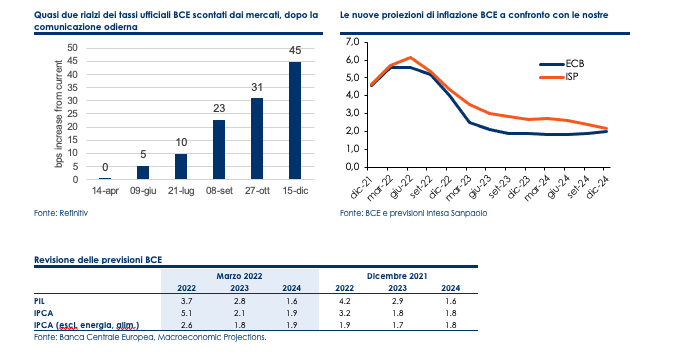

The staff's forecasts for 2022 appear surprisingly optimistic, in light of the strong increases observed in energy. GDP growth is forecast at 3.7% in 2022, slowing to 2.1% in 2023. Our current assessment is that average annual growth is likely to be in the order of 3%, while we expected growth of 3.8% before the war. The revision of inflation estimates brings the annual average forecast by the ECB to 5.1% in 2022 and 2.1% in 2023. The 2024 forecast, revised up by one tenth, is just below 2%. Despite the revision, the new inflation projections remain below ours over the entire forecast horizon.

The staff also posted two alternate scenarios, one adverse and one severe. In the adverse scenario, the ECB incorporates persistent reductions in Russian gas supplies, with temporary negative effects on production. In this scenario, 2022 GDP growth is 1.2 points lower than the base scenario, while inflation is 0.8 points higher. In the severe scenario, the ECB assumes a more intense reaction to energy prices and greater financial effects: the result is a lower growth of 1.4 points and a higher inflation of 2 points, as well as a greater temporal persistence of the effects .

Today's announcements are consistent with the scenario of a first rate hike in the fourth quarter of 2022, as per our central forecast. The markets returned to discount 2 rate hikes by the end of the year, the first on September 8 and the second on December 15. Technically, a rise in September cannot be ruled out, but it seems unlikely out of very benign scenarios of impact of the crisis.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/perche-la-bce-e-flemmatica-nonostante-la-guerra/ on Sun, 13 Mar 2022 14:42:08 +0000.