Why the Central Bank of China has cut rates

With negative data on demand, industrial production and youth unemployment, China's central bank cut interest rates for the first time since January. All data and expert opinions

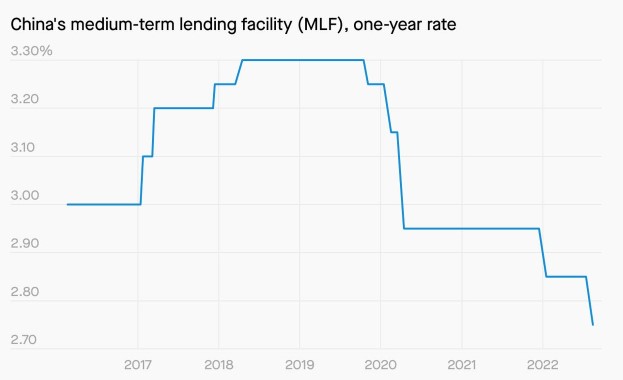

The People's Bank of China, the central bank of China, cut interest rates on annual loans by 10 basis points on Monday to 2.75 percent. This is not only the first reduction since last January, but also a move contrary to the forecasts of analysts, who did not expect changes from the institute.

LOCKDOWN , REAL ESTATE CRISIS AND LOW GLOBAL GROWTH

According to the Financial Times , the central bank's decision highlights Beijing's growing anxiety both for the drop in consumer demand caused by the strict policy of containing coronavirus infections (nicknamed "zero-COVID"), and for impacts of the liquidity crisis of real estate development companies and the slowdown in global economic growth.

HOW IS THE ECONOMY OF CHINA: THE DATA

Official statistics released on Monday show worse-than-expected levels of consumer demand and industrial activity. The youth unemployment rate reached 19.9 percent, a record high.

In July, retail sales (an important indicator of consumption) rose by only 2.7 percent, compared with the forecast of 5 percent. Industrial production grew by 3.8 percent, while forecasts indicated a +4.6 percent.

BECAUSE THE PRICE OF OIL FALLS

News of the slowdown in the world's second largest economy led to a 4.6 percent drop in crude oil prices, of which China is a major consumer and importer.

WHAT THE EXPERTS THINK

Despite massive (in the hundreds of billions of dollars) capital injections to stimulate growth, the Chinese economy avoided contraction only slightly in the second quarter of the year.

According to experts, this slowdown will induce the authorities to "ease" monetary policy, but some of them are pessimistic. For example, Ting Lu – Nomura's China economist – told the Financial Times that "Beijing's support may be too low, too late and too inefficient": the country's growth in the second half, he said. , will therefore be "significantly hampered by its zero-COVID strategy, the downward spiral of real estate markets and a probable slowdown in export growth".

Other analysts argue that the central bank's interest rate cut is an important signal of Beijing's willingness to continue stimulating the economy through monetary policy rather than focusing on inflation.

THE (NEGATIVE) OPINION OF SOCIÉTÉ GÉNÉRALE

The Société générale bank defined the July data as "simply negative", emphasizing the deceleration of production, investment and consumption due to the "crushing weight of the zero-COVID policy" and the "real estate sector in free fall ".

According to the bank's economists, “[Chinese] policymakers have begun to communicate their concerns about overstimulating the economy with too much liquidity, while in our view the real risk is just the opposite: too little easing and a recovery too weak ".

ZERO-COVID

The zero-COVID policy pursued by President Xi Jinping consists of the imposition of strict lockdowns whenever coronavirus outbreaks are detected. Over the weekend there was an increase in cases nationwide, and in several cities in the country – in Haikou and Urumqi, for example – restrictions on travel and activities were imposed or extended. In Shanghai, then, the authorities are testing the use of drones to monitor citizens and make sure they scan their "health codes" when they enter a building; these codes are recorded in a smartphone application and are used to determine whether a person is positive for the virus or not, and if he can therefore move around the city.

WITH "NO QUESTION" LOCKDOWN

Xingdong Chen, economist in charge of the China section of BNP Paribas, explained to the Financial Times that “China is certainly in a very desperate situation. The problem is that there is no actual demand. If people are not allowed to go out and consume… there is no demand ”.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/perche-la-banca-centrale-della-cina-ha-limato-i-tassi/ on Tue, 16 Aug 2022 08:30:35 +0000.