Will it be sunny on the financial markets in June?

The analysis by Antonio Cesarano, Chief Global Strategist of Intermonte

The last week of May showed a consistent recovery of the equity markets, which can be linked to two factors:

- partial recovery from excesses reported by some Financial Conditions indicators, one for all the fear & greed

- effect of month-end rebalances, which JPM estimated in the range of $ 34-56bn by balanced mutual funds

What to expect, at this point, for June and for the summer? I state the general view, and then go into the details:

- June could represent a sort of respite on average, especially in the second part of the month, in view of very substantial rebalancing

- the declining trend of the stock markets could however resume during the summer

So, in summary, borrowing a meteorological image, more frequent sunbursts in June in view of an average rainy summer.

We come to the details of the reasons for this view:

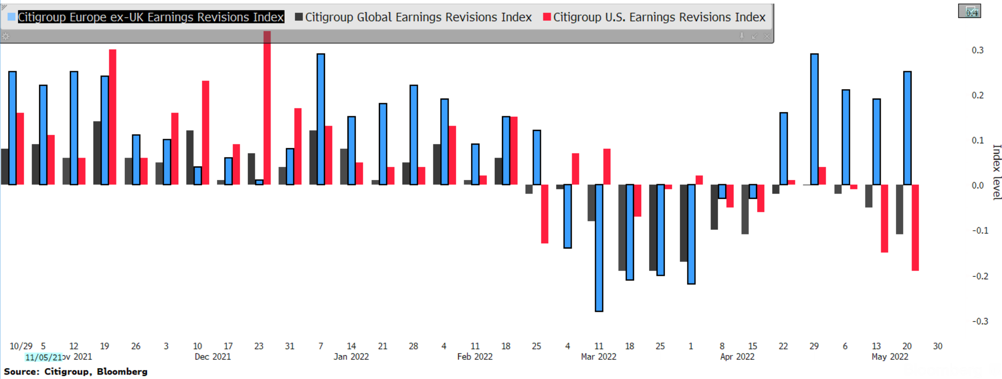

June: no updates from the micro / corporate side are expected this month, as the US quarterly season has just ended, which has on average brought good final results, in several cases, however, more than balanced by guidance in the opposite direction, especially under the margin profile. In the USA, the pejorative revision of earnings estimates began.

In June, therefore, in the absence of micro updates (except for extraordinary announcements) and assuming the continuation of the low-intensity war together with attempts to ease Chinese lockdowns, the factors of greatest attention will be represented by macro data and central banks (9 June ECB and June 15 Fed).

For central banks, the rate hike path has been practically already discounted by operators and the possible acceleration or otherwise of the ECB departure (25 vs 50 bps) and the hypothesis of slowing / accelerating the Fed's rate of rise remains to be defined. September, after hikes of 50bps in June and July.

- The central part of June could therefore be the most subject to turbulence to adapt to the forward-looking indications of the two central banks.

- The second part could be impacted overall by the substantial rebalancing flows from global sovereign / pension funds, estimated by JPM in an amount of up to $ 207 billion.

From July, however, the sky could return to cloudy, in view of:

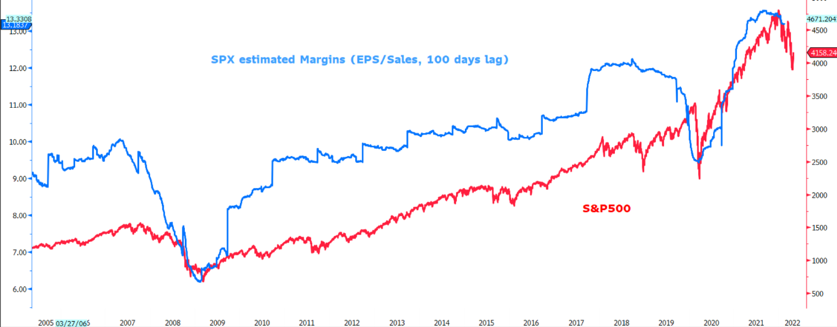

- resumption of the micro update (US quarterly season will resume from mid-July) which could signal further stress on the corporate margins due to high inflation and the impact of restrictive monetary policy maneuvers;

- more visible impact of the reduction in liquidity in the system due to the departure of QT plans (Fed from June and then the BoE in the summer, with the ECB stopping QE from July);

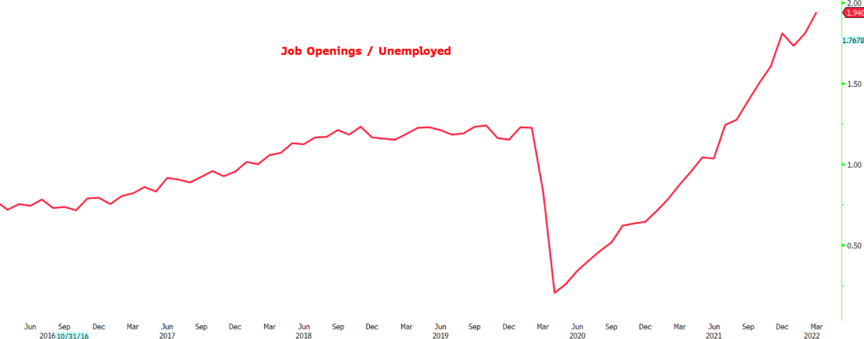

- signs of a downsizing of the strength of the US market, especially on the job supply side, as signaled by some leading indicators (for example the trend of breakeven inflation) vs the JOLTS report which precisely monitors the trend on the job offer.

Today the job market has a strong supply / demand imbalance, with about two jobs offered for every unemployed worker, a factor often cited by Powell. During the summer we could see a reduction of this imbalance, with companies reducing the jobs offered in view of a macro picture of marked slowdown on the border with the prospective recession in 2023 (as signaled by the inversion of the interest rate curve at the beginning of April).

In summary:

- in the summer months, the factors outlined above could resume the downward trend in view of further cuts in the consensus of company margins and more balanced levels between market capitalization and liquidity in circulation, decreasing due to the QT / stop QE.

- The cuts in company margins historically arrive with about 100 working days delayed compared to the trend in prices. In turn, the achievement of estimated levels of margins significantly lower than the current ones could represent a good indicator of the possible minimum level of achievement of the equity indices.

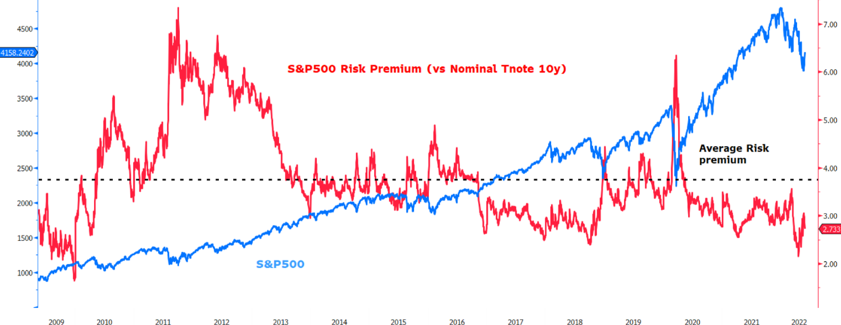

All these factors could contribute to converging the risk premium towards levels more in line with the long-term historical averages.

- The contribution could come in part from the upward revision of the learning yield (due to both the worsening revisions of earnings and the drop in prices) and in part from the contextual decline in nominal long-term rates.

OPERATIONAL

June could offer an average positive performance with possible turbulence around the middle of the month, in correspondence with the ECB and Fed meetings. The “sunniest” part could arrive in the second fortnight due to the support of the substantial rebalancing at the end of the quarter / semester.

In this context, growth could outperform value on average.

The financial conditions index are always important as useful indicators for identifying entry points, as well as ratios borrowed from the world of options such as the VIX / SKEW ratio.

July / August is the period in which the factors outlined above (QT / stop QE, updated indications from the quarterly and slowdown in the dynamics of the US labor market) could bring about a resumption of the declining trend of the Stock Exchanges

At the same time, we could see the continuation of the decline in rates, especially in the short term in the US, in view of a perception of a higher risk of recession in 2023, such as to force the Fed to reverse after the rapid rate hike and QT that it could begin to end around the November mid-term elections, as is already partly discounted by the bond market.

To identify the potential low point for the year, it is important to monitor the level of the risk premium achieved jointly with two other indicators:

- the level of pejorative revisions reached on the corporate margins front

- the market cap / liquidity indicators ratio.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/ci-sara-il-sole-sui-mercati-finanziari-a-giugno/ on Sun, 05 Jun 2022 05:16:36 +0000.