Will the real estate ghost haunt the banks?

![]()

The real estate sector is weak due to the increase in the cost of loans: here are the possible consequences for the banks. The analysis of the BG Saxo research centre

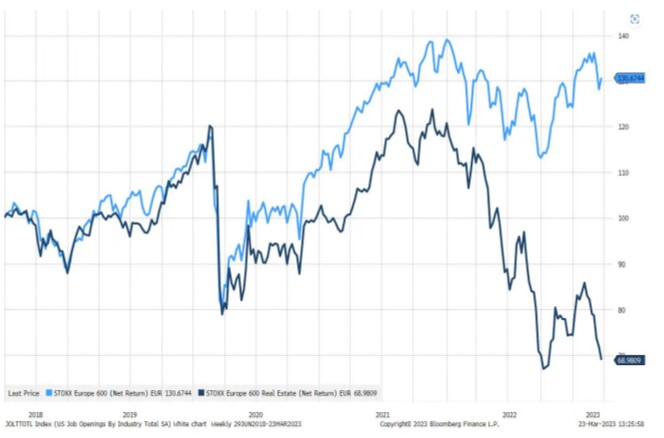

European real estate companies are down 43% since December 2021 as higher interest rates are reducing their asset values and over time rising interest expenses have dented their operating cash flows.

THE GAME ON DEPOSIT IN BANKS

As already mentioned in several equity reports, there is a “deposit game” going on in the banking system which, in the case of SVB Financial , caused a forced sell-off of assets to pay for runaway deposits which ultimately resulted in its failure. Real estate companies can end up in the same situation if banks ask these companies to reduce their debt levels.

THE MARKET VALUE OF REAL ESTATE COMPANIES ON THE STOXX

The 33 real estate companies in the STOXX Europe 600 Real Estate Index represent a market value of €138 billion. These asset values no longer reflect the true value visible from the price-to-book ratio which has fallen to 0.7x for the sector, suggesting expectations of declining asset values.

THE MORTGAGE RATE

The current EU average mortgage rate was 3.1% in January. If the mortgage rate rises to 5% as it did in 2007, real estate companies will spend most of their cash flows servicing their debt, leaving little value for shareholders.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/fantasma-immobiliare-banche/ on Tue, 28 Mar 2023 06:14:30 +0000.