Recession and crisis: make no mistake, now the worst will come

So far we have witnessed a dichotomy between the real life of citizens crushed by inflation and the fall in their purchasing power, and on the other hand the world of official statistics and finance, which still seems to have hardly been affected by the current situation, to the point of suggest a “virtual” crisis.

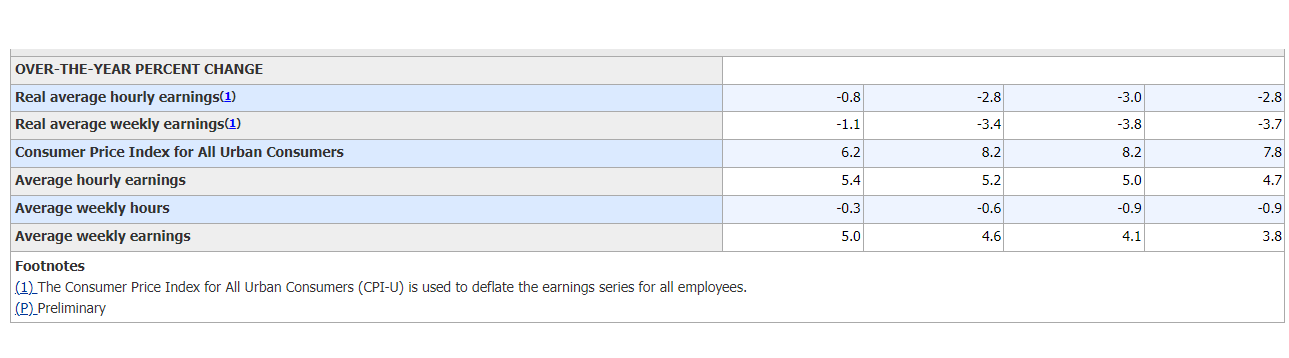

In reality we are probably in the preparation phase for the great crisis. Real wages around the world are declining. Even in the USA, the country that still seems to be experiencing a moment of glory, real wages are declining, as can be seen from this table from the BLS :

Over the past week, Goldman Sachs CEO David Solomon warned of "tough times" and a tougher economic environment, while JPMorgan CEO Jamie Dimon predicted a "mild to hard recession." Trivial statements for those who read Scenarieconomici, but which were taken with a certain surprise on the markets.

The recession will differ from country to country: for example China, which is part of one of the countries with the lowest inflation, will be affected differently than countries, such as the West, with higher inflation. The fall of the financial markets will have different effects on a case-by-case basis, but will undoubtedly be transmitted globally.

The crisis is imminent, but meanwhile all investors, market analysts and even official politicians are either burying their heads in the sand or haven't been around long enough to realize that all stocks, good or bad, have consequences and that these consequences take some time to manifest.

The ability to see beyond actions and evaluate their impact seems to have failed. This may be a product of the digital age and extreme data reliance. Or as the poet TS Eliot asked: “Where is the wisdom we have lost in knowledge? Where is the knowledge that we have lost in information?”. Today, in theory, everyone has information, but what's the use if they no longer know how to grasp its consequences?

It has long been clear that the global economy was bound to have problems, certainly since the global financial crisis of 2008 (not even considering the excesses of the financial system that led to that disaster). The great experiment in monetary easing began just then.

Quantitative easing and qualitative easing have arrived, along with historically low interest rates. These interventions were designed to save the financial system and to avert a recession. They didn't trigger inflation because the money was pumped into the banking system rather than directly into the real economy.

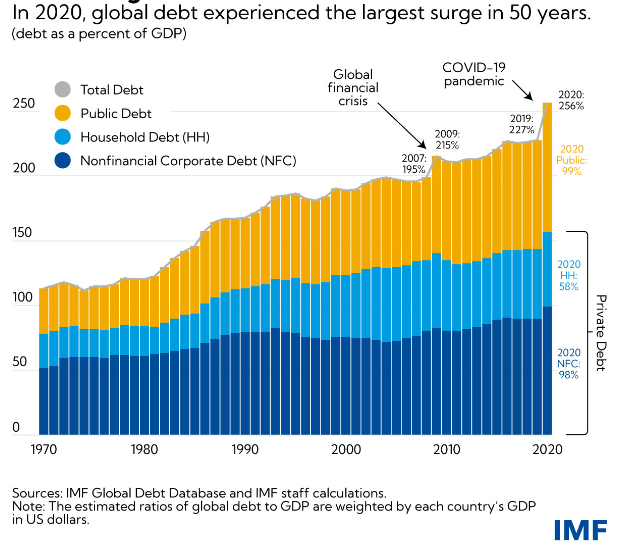

The cheap money however triggered a wave of borrowing by companies, households and governments, setting the stage for trouble when interest rates started to rise, as they inevitably would. That moment came as governments began to convert monetary stimulus into fiscal stimulus.

The impact of COVID-19 on economic activity and supply chains has been addressed with massive direct transfers of public money to households. In other words, the banking system's "liquidity" was converted into spendable cash, and once Covid-19 subsided, consumption fueled by these government transfers took off.

Demand has soared, but the supply of goods, hit by supply chain disruptions due to trade and political reasons and by Covid, has not been able to keep pace. With the war in Ukraine underway, energy prices have joined those of other goods in an upward spiral. Inflation had indeed "arrived", "present" and not "transient".

Central banks reacted in panic by aggressively raising interest rates to compensate for their past insensitivity to inflation risks, without assessing the causes of inflation itself, with a Pavlovian response. This should have shaken the markets – especially the stock market – but it hasn't, or rather it hasn't STILL. Yet the signs of the imminent crisis are all there, also because NOW the huge global debt problem will break out.

The stock of debt today amounts to about 290,000 billion dollars and the prevailing part is that of private, household and corporate debt. This debt is much more dangerous because the decreases in interest rates by central banks are immediately reversed on this type of debt, without the "moderating mediation" that central banks still exercise on public debt, with European exceptions. Debt has not been proven, cuts borrowers' incomes, leads companies into crisis and the impact of rising rates will therefore be devastating. And this not only in developing countries, as the IMF seems to remind us, but also in the countries closest to us.

Inflation will fall, indeed it is already falling, but this will be a negative sign, accompanied by the fall in personal income from consumption, work and financial values. Different countries will be affected differently by the phenomenon, but the result will always be the same, even if it is sad to say it during the Christmas period: crisis, unemployment and poverty.

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article Recession and crisis: make no mistake, now the worst will come comes from Scenari Economici .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/recessione-e-crisi-non-illudetevi-ora-arrivera-il-brutto/ on Sun, 11 Dec 2022 15:41:53 +0000.