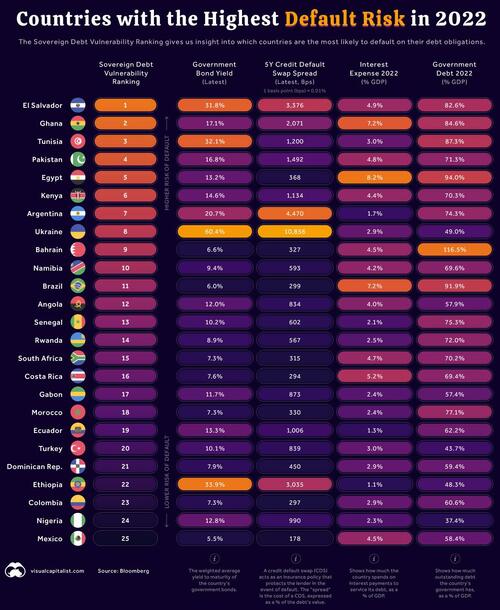

Which countries have the greatest risk of default?

In May 2022, South Asian nation Sri Lanka defaulted on its currency debt for the first time. The country's government was given a 30-day grace period to cover $ 78 million in unpaid interest, but ultimately failed to pay.

This not only has an impact on Sri Lanka's economic future, but, as Visual Capitalist's Marcus Lu notes, it also raises an important question: Which other countries are at risk of default?

To find out, there is an assessment based on Bloomberg data that draws up a ranking of the countries with the highest risk of default. Here it is for you, with some surprises:

The parameters used to assess the debt risk are:

- Government bond yields (the weighted average dollar bond yield of the country)

- 5-year credit default swap (CDS) spread

- Interest expenditure as a percentage of GDP

- Public debt as a percentage of GDP

We note that the important data is that of foreign currency debt. Internal debt default is impossible EXCEPT that, for now, in the Euro area.

To better explain the ranking let's focus on two countries: Ukraine and El Salvador

Ukraine presents a high risk of default due to the ongoing conflict with Russia. To understand why, consider a scenario in which Russia were to take control of the country. If this happens, it is possible that Ukraine's current debt obligations will never be repaid.

This scenario resulted in a sell off of Ukrainian government bonds, causing their value to drop to almost 30 cents. This means that a bond with a face value of $ 100 can be bought for $ 30.

As yields move in the opposite direction to the price, the average yield on these bonds rose to 60.4%. For comparison, the yield on a 10-year US government bond is currently 2.9%.

What is the CDS spread?

Credit Default Swaps (CDS) are a type of derivative instrument (financial contract) that provides a lender with insurance in the event of a default. The seller of the CDS represents a third party between the lender (the investors) and the borrower (in this case, the governments).

In exchange for hedging, the buyer of a CDS pays a commission known as the spread, expressed in basis points (bps). If a CDS has a spread of 300 bps (3%), it means that to insure $ 100 of debt, the investor has to pay $ 3 per year.

Applying this figure to Ukraine's 5-year CDS spread of 10,856 bps (108.56%), an investor would have to pay $ 108.56 per year to insure $ 100 of debt (although in practice this is an advance payment and then a steady stream of payments, which implies that insolvency is likely in the very short term). This suggests that the market has little confidence in Ukraine's ability to avoid default.

Why is El Salvador in first place?

Despite the lower values in the two metrics discussed above, El Salvador ranks higher than Ukraine due to higher interest spending and total public debt.

According to the above data, El Salvador has an annual interest expense of 4.9% of GDP, a relatively high value. Making a further comparison with the United States, the costs to America's federal interests amount to 1.6% of GDP in 2020.

In total, El Salvador's debt is 82.6% of GDP. This value is considered high by historical standards, but it is quite normal today.

The next date to watch will be January 2023, when the country's $ 800 million sovereign bond matures. Recent research suggests that if El Salvador were to default, it would suffer significant but temporary negative effects.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article Which countries have the greatest risk of default? comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/quali-sono-i-paesi-che-hanno-il-maggior-rischio-di-default/ on Sun, 17 Jul 2022 11:03:48 +0000.